interest tax shield fcff

According to Brealey et al. This is usually the deduction multiplied by the tax rate.

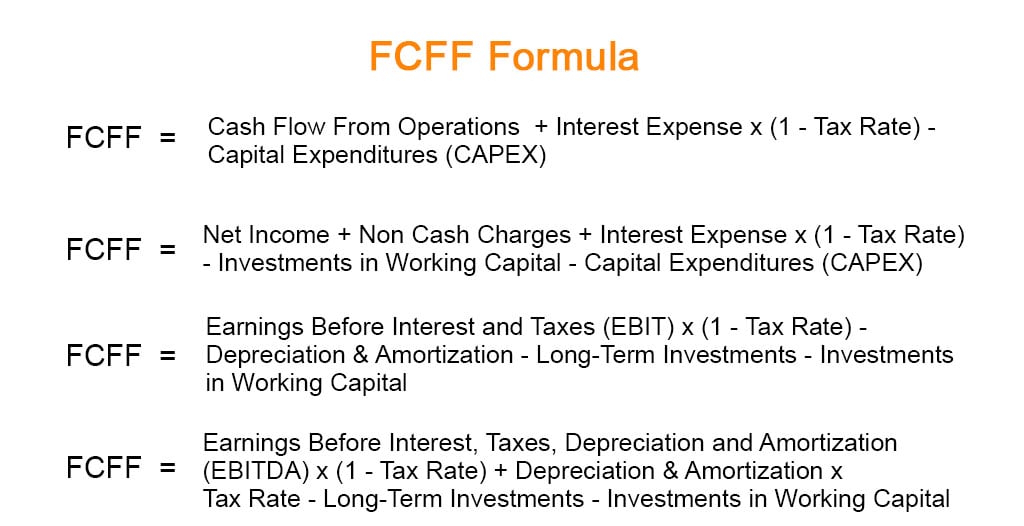

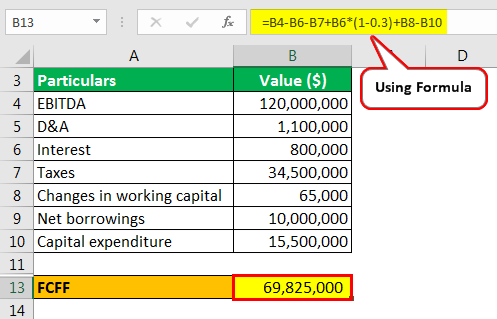

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

If the tax rate is 10 then the tax liability will be 4000.

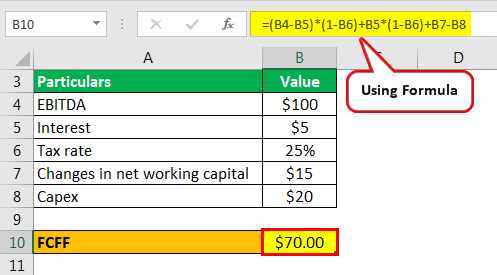

. For claritys sake you can also think of FCFF as Cash Flow from Operations CFO Interest Interesttax rate CAPEX. Tax shield of interest is a result of particular capital structure. On the cash flow statement the CFO section has the bottom line from the income statement at the top which is then adjusted for non-cash expenses and changes in working capital.

This is done by subtracting the tax amount from EBIT. The calculation of FCFF begins with NOPAT which is a capital-structure neutral metric. The effect of a tax shield can be determined using a formula.

The Interesttax rate is called a tax shield and is used to reduce the tax benefit of interest expense thats included in CFO we used interest in CFO to reduce taxable income and need to reverse that benefit. NI Net income NC Non-cash charges I Interest TR Tax Rate LI Long-term Investments IWC. The 25 between the two scenarios is the tax shield.

By taking on an extra 50 in interest payments FCFF increased by 25. FCFF CFO Interest Expense 1 Tax Rate CapEx. Hence its EBIT will be reduced to 600.

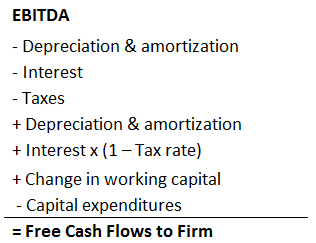

Tax Rate 2462. FCFF Net Income Non-cash Charges Interest 1 tax rate CapEx Change in Working Capital. Add back depreciation and amortization.

Finance cost is tax deductible hence account for tax shield illustrating adding back finance cost to Net Profit to arrive to FCFF Terminal year normalization. FCFE Net Income DA Change in NWC CapEx Net Borrowing. FCFF is cash available to Equity AND bond holders.

Here is a step-by-step breakdown of how to calculate FCFF. Interest expenses are considered to be tax-deductible so tax shields are very important as firms can get benefits from the structuring of such arrangements. FCFF NI NC I 1 TR LI IWC where.

It is also important to keep in mind that the interest tax shield value is the present value of all the interest tax shields. At a later stage on the income statement the company will pay 40 of this 1000 as cash flow. So far we have considered cash flows in the forecast period.

However the shield is off course limited to the expense incurred as interest due to the debt in each year and is offset from the income for that year to arrive at taxable income. An interest tax shield is defined as. FCFF is calculated using the formula given below.

However students usually get confused by the absence of the ctax shield. It will be clear with the help of the following hypothetical scenarios. The thing that bothered me was that the above equation appeared to ignore a very real cash flow in computing FCFF the tax savings from interest expenses.

Please note that we need to multiply the finance cost by 1 tax rate to account for the tax shield from the finance cost. Unlevered FCF cash the business has before paying its financial obligations. A Tax shield is a necessary reduction in an individual or corporations taxable income achieved when a huge amount of expenses incorporate with total income such as mortgage interest.

FCFF includes an interest tax shield as opposed to FCFE. That is an economic cost. Accordingly EBIT1-T also known as Net Operating Profit after Tax NOPAT is a measure of profit that excludes the costs and tax benefits of debt financing.

According to Damodaran 5 the interest tax shield is expressed in a similar vein. You are right that the amount available to equity holders is less but the FCFF is higher. FCFFa EBIT 1-tax rate NCC WCI FCI 1 This formula is quite popular in practise.

They recognize the underlying expenses while calculating net cash Net Cash Net Cash represent the companys liquidity position and is calculated by deducting the current liabilities from the cash balance reported on the companys financial statements at the end of a particular period. For avoidance of doubt. Tax Shield Deduction x Tax Rate Adding Back a Tax Shield When adding back a tax shield for certain formulas such as free cash flow it may not be as simple as adding back the full value of the tax shield.

Interest is tax-deductible and the resulting tax savings reduce the cost of borrowing to firms. 1 Interest expense is not included because it is paid to bond holders. 2 EBIT is multiplied by 1-Tax rate to account for the interest tax shield tax avioded via interest tax deduction.

They think tax shield which is interest expenses tax rate should be added back to calculate FCFF because most companies deduct interest expenses in calculating taxes. Medical expenditure charitable donation and depreciation. Deduct the hypothetical tax bill from EBIT to arrive at an unlevered Net Income number.

For example the EBIT was 1000 and there was a 40 tax rate. However be careful to not just pull the CFO figure from the financial statements without confirming the non-cash charges. FCFF Net Income Non cash Expenses After Tax Interest FC inv WC Inv Now with regards to the after tax interest expenses we do not need to add them back.

Thus interest expenses act as a shield against tax obligations. The interest tax shield is positive when the EBIT is greater than the interest payment. Free Cash Flow to the Firm FCFF Cash Flow from Operations Interest Expense 1 Tax Rate Capital Expenditures CAPEX.

That means that tax shield is generated by actual economic activity. You have a worn out machine. As far as the cash flow to equity shareholders is concerned interest expenses are included in the outflow and hence do not need to be added back.

The tax shield is the amount saved in taxes by paying interest. Interest expenses via loans and mortgages are tax-deductible meaning they lower the taxable income. Having said that if tax rate is say 30 on an interest expense of 100 the tax saved is 30 100 30.

For instance Suppose Company A has earned a profit before interest and tax of 40000 for a year. That is why tax shield of interest is reduced in FCFF computation. 2Tax shield of depreciation is a result of economic activity.

Tax savings resulting from deductibility of interest payments. For FCFE however we begin with net income a metric that has already accounted for the interest expense and tax savings from any debt outstanding. Start with Earnings Before Interest and Tax EBIT Calculate the hypothetical tax bill the company would have if they didnt have the benefit of a tax shield.

EBIT1-T earnings before interest and taxes EBIT adjusted for the impact of taxes NOPAT. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax rate is. We therefore need to adjust the EBIT for taxes and make it a post tax EBIT number.

Fcff Formula Examples Of Fcff With Excel Template

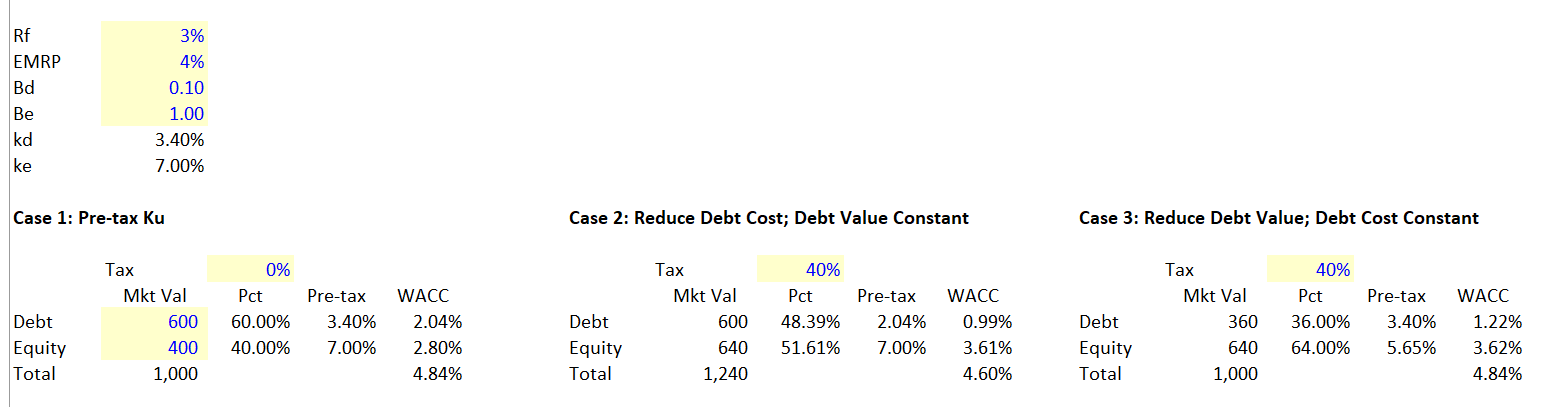

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Tax Shield Formula How To Calculate Tax Shield With Example

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Unlevered Free Cash Flow Definition Examples Formula

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)